Comprehensive Guide: Why Your Aadhar-PAN Link Matters

Welcome to your comprehensive guide through the intricate world of Aadhar PAN Card Link Status! You might be wondering why you should give this article any attention at all – after all, isn't checking your own financial records a daunting task? The reality is that when it comes to managing tax payments and income declaration, ensuring an accurate link between your Aadhaar card (the unique biometric ID) and your PAN Card (an authentication number for all income-related transactions in India), you simply cannot afford any mistakes.

Imagine this: You’ve recently filed your annual Income Tax Return. Everything looks good on the surface – no major discrepancies or missed payments, but under-the-hood, a critical piece of information is missing that could affect everything from future tax rates to your financial health down the line if not corrected promptly. This piece-of-cake task falls squarely into such categories.

The Indian Income Tax Department has made it their mission to ensure every taxpayer has an accurate link between these two essential identification tools. By offering online facilities where you can enter both numbers and instantly know whether everything is in place or needs a bit of fine-tuning, they empower millions like us who are conscientious about our financial records.

Now, let's dive into what this article will cover for those looking to ensure their Aadhar-PAN status meets the necessary standards. First off, we'll discuss how you can access these services online via e-Filing Portal or any other National Government Services Platform available on your device of choice – be it desktop computer, laptop, tablet, even smartphone! Then, I’ll outline step-by-step procedures for accurately linking both cards and highlight potential challenges along the way. Finally, we'll look at common FAQs that often arise from this process so you can avoid any unpleasant surprises.

This article aims to demystify what might seem like a daunting task but which is actually as straightforward as following clear instructions – once you know where to go first! Stay tuned for an informative journey through ensuring the most accurate and secure financial status possible in India. Keep your eyes peeled, because every link counts towards making this process smooth sailing.

The Full Story: Comprehensive Details and Context

The Aadhar-PAN linking process is an essential part of ensuring financial transparency in India. Essentially, it's about making sure that your unique biometric ID (Aadhaar) matches up to the tax filing identification number you use for all income-related transactions (PAN). This connection helps streamline processes like Tax Deduction at Source (TDS), where businesses deduct taxes from payments they make on behalf of their employees or suppliers.

For individuals who already have a PAN card issued by 1 July 2017, linking Aadhaar is mandatory to avoid potential issues that could arise in the future. The deadline for this linkage was set at June 30, 2023.

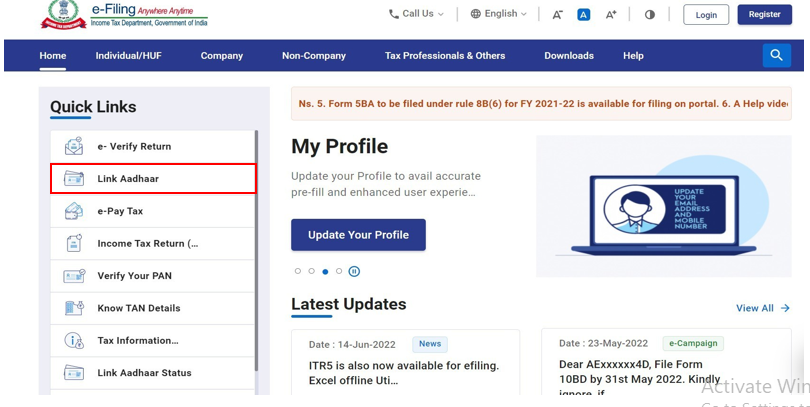

If you're looking to initiate this process yourself on e-Filing Portal, here's a step-by-step guide based on the Link Aadhar User Manual from Income Tax Department:

Key Developments: Timeline and Important Events

-

Automatic Enrollment: For new applicants of PAN cards who apply online or through offline channels (like bank branches), their Aadhaar link is automatically created during this process.

-

Mandatory Mandatory Period: All existing unlinked PAN card holders were required to have an Aadhar-linked PAN by June 30, 2021. Those without will see their PAN cards marked as 'inoperative' and cannot be used for any tax-related transactions thereafter.

-

Late Fee Reminder: From October 15, 2021, the Income Tax Department started sending SMS reminders to individuals who still hadn't linked their Aadhaar by June 30th of each year. If not done within one month after receiving this reminder (ending December 15), a late fee begins accruing.

-

Link Fee Payment: There’s no cost involved for the first link, but if you need to re-link due to any discrepancies or new identity changes in Aadhaar details, there might be additional costs associated with it.

Multiple Perspectives: Different Viewpoints and Expert Opinions

From a taxpayer's perspective, ensuring accurate links between their PAN card and Aadhar is crucial. It helps prevent errors that can lead to financial penalties if not caught promptly. The Income Tax Department has made this process as easy as possible via online portals like e-Filing Portal.

For tax administrators within the government, managing these linkages efficiently ensures smoother operations while maintaining data integrity across different systems used in India’s fiscal machinery. This includes seamless integration with various databases including those for social security benefits and healthcare reforms under way globally in many countries but still nascent or experimental here.

Broader Context: How It Fits into Larger Trends

While the Aadhar-PAN linking process is unique to Indian taxation, it aligns well with broader international efforts towards digitization of identity management. Countries like Estonia have successfully implemented similar linkages as part of their national ID systems which serve multiple governmental services including healthcare and education.

In India specifically, this initiative supports Prime Minister Narendra Modi’s digital economy strategy aimed at reducing physical document processing in favor of e-governance solutions for enhancing transparency and efficiency among citizens while simultaneously improving governance effectiveness.

Real-World Impact: Effects on People, Industry, Society

For individual taxpayers like you or me:

- Peace of Mind: With accurate linkages between your Aadhaar ID and PAN card, there’s less chance of getting penalized due to mismatched IDs.

- Efficiency Gains: Easier identification processes mean quicker transactions during tax filing, deductions from payments made by employers on behalf of employees (TDS), among others.

For the Indian economy as a whole:

- Simplified Operations: By automating ID verification processes through Aadhaar linking with PAN cards, administrative burdens can be significantly reduced.

- Enhanced Transparency & Accountability: Greater ability to track tax payments and benefits received ensures higher levels of accountability in public expenditures made via government programs.

In conclusion, ensuring accurate links between your Aadhar card and PAN card is a win-win situation – it helps protect you from unnecessary bureaucratic hassles while promoting smoother financial operations for all stakeholders involved. Stay tuned as we continue exploring more aspects related to this crucial aspect of tax filing compliance!

Summary

In summary, ensuring an accurate Aadhar-PAN card linkage is not just another formality; it's crucial for maintaining financial integrity in our tax system. The Income Tax Department has made this process straightforward through their online platforms, making it easy to verify the connection between your unique biometric ID and your PAN number.

For individuals like you or me who are already registered with a PAN card by 1 July 2017, linking Aadhaar was an automatic part of our application. For those without that link, there’s still time until June 30, 2023 to ensure everything is in order before facing potential consequences.

The benefits extend beyond avoiding penalties; accurate and timely connections streamline tax filings and deductions for employers on behalf of their employees (TDS). This digital transformation not only simplifies administrative tasks but also enhances accountability within the government’s operations across various sectors like healthcare, education, and social security.

Looking ahead, as India continues to digitize its identity management systems, staying proactive with these linkages will become even more important. The broader implications of a seamless Aadhar-PAN connection contribute significantly to building trust in digital governance initiatives aimed at improving efficiency without compromising privacy or accuracy.

So what now? As we move forward into this era where biometric IDs are increasingly becoming the norm for identity verification, ensuring our links remain accurate and up-to-date will be as vital as ever. Are you ready to keep your financial status secure with these connections in place?

This comprehensive guide has given us valuable insights today – but perhaps a deeper understanding of how digital identities impact daily life is yet another aspect worth exploring? What do you think about the future of Aadhar-PAN link statuses and its potential implications on personal finance, public services, or even broader societal structures? Leave your thoughts below!