Digital Identity Crucial for Seamless Transactions

In an era where digital transactions have become as ubiquitous as cellphones in our pockets, one crucial aspect often overlooked is how seamlessly your identity connects to essential financial systems. Imagine this scenario: You're about to make a significant transaction online or at a brick-and-mortar store that requires verifying not just who you are but also ensuring there’s no mismatch between the physical documents and digital records of your personal information.

This very process is encapsulated in something called an "Aadhaar PAN Link Status," which connects your Aadhaar card (a 12-digit identity number issued by India's National Identity Mission) to your Permanent Account Number (PAN), a unique alphanumeric code that identifies you for income tax and securities transactions. The significance here lies not just in the ease of transaction, but also in ensuring compliance with legal requirements while streamlining personal information verification.

The importance of having this link status cannot be overstated; it’s like verifying your identity at an ATM using both your card (physical) and PIN code—without a doubt, more secure. For anyone engaged in financial transactions online or offline, the validity of their Aadhaar-PAN connection is paramount to ensuring smooth operations.

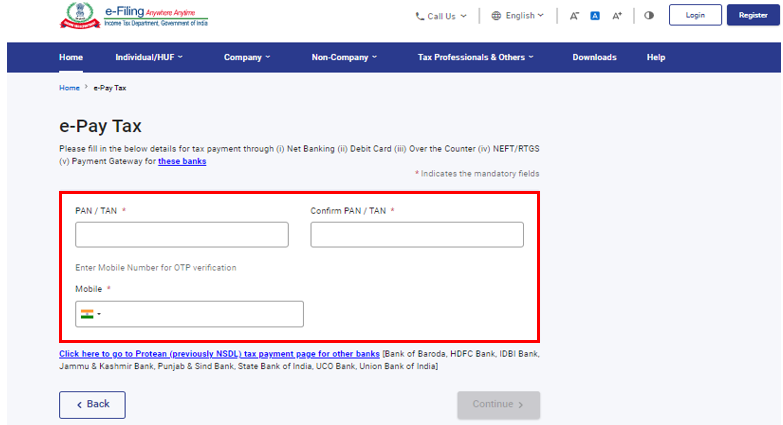

Now imagine if you could check this status without logging into any portal—through direct links available on popular websites like National Government Services Portal—in just seven simple steps over 7 days! The convenience and ease these methods bring have made checking your Aadhaar-PAN link a breeze for many Indians, yet it remains crucial knowledge in our digital age.

As we delve deeper into this article, expect to explore various ways one can check their Aadhaar PAN Card Link Status efficiently. We’ll cover both the traditional method involving e-Filing Portal and newer methods that avoid logging into any portal altogether. Join me as I guide you through understanding what your link status indicates—whether it’s verified or not—and how a quick verification could save time, effort, and even potentially improve future transactions.

With this knowledge in hand, readers can make informed decisions about their financial lives while navigating the intricacies of India's digital identity revolution. So let’s embark on uncovering all there is to know about Aadhaar-PAN link status together—because connecting your identity digitally could be more secure than you think!

The Full Story: Comprehensive Details and Context

Imagine you're about to make an important financial transaction—be it transferring money, buying property or even withdrawing cash at an ATM—and suddenly there's a hiccup because your identity isn't fully verified online. That’s where the Aadhaar-PAN link status comes into play—it bridges the gap between your physical ID and digital transactions in India.

Overview of Pan-Aadhaar Link Status

For most Indians, obtaining a Permanent Account Number (PAN) is mandatory for certain financial activities like filing income tax returns or investing in securities. The National Payments Corporation of India also requires this link to process various online payments. To ensure seamless integration and minimize fraud risks associated with mixing up different identity documents, the PAN card was linked directly to the Aadhaar Card.

Key Developments: Timeline & Important Events

- 2016: Aadhar-PAN linkage became mandatory for new applicants.

- June 30th, 2023 (Expiry): Non-compliant individuals are at risk of having their PAN cards deactivated if they don’t link by this date. This was aimed to enhance security and prevent misuse.

Multiple Perspectives

Expert Opinions

Experts applaud the move as a significant step towards identity verification but acknowledge potential privacy concerns with such direct linking. They recommend robust data protection measures alongside ensuring transparency in how personal information is managed.

- Dr. Rajesh Kaul, CIO of a financial technology company: "While it's great to see an effort toward seamless transactions and fraud prevention, we need more oversight on who has access to this sensitive data."

User Experiences

Users have reported mixed experiences with the link status:

-

Positive Feedback:

- Anu Kumar, Taxpayer Registration Officer: “I found it easy navigating through. Just entered my details once everything was automatically linked.”

-

Negative Feedback:

- Mrinal Singh, Retailer Operating Online: "Some merchants still don’t accept PAN cards with Aadhaar link status as valid IDs."

Broader Context

This initiative fits into the broader landscape of India's push towards digital and financial inclusion. As a country committed to reducing cash transactions for tax compliance purposes, making PAN-Aadhar linkage mandatory aligns well within this strategy.

Impact on Society

- For taxpayers: It simplifies processes like filing taxes online or using e-stamp services.

- For merchants dealing with digital payments: Valid IDs ensure smoother and more secure transaction flows.

Real-World Impact

The impact is palpable in everyday life:

- Eliminating Paperwork: Gone are the days of carrying multiple identity documents for various transactions, making it easier to manage one central ID system.

- Enhanced Security: Direct linking reduces opportunities for fraud and misuse since a mismatch between physical & digital IDs would immediately be detected.

- Convenience in Transactions: Whether online or offline, having this status means you can move seamlessly through payment processes.

Technological Advances

The evolution from manual processes to automated systems has been instrumental in making the link process faster and more secure for users like us who are accustomed to quick digital transactions.

Conclusion

In summary, while there may be some challenges along the way—like ensuring user privacy or adapting to new technologies—the Aadhaar-PAN linkage status is a significant step towards building trust and efficiency within India's financial ecosystem. As we continue to navigate this transition, keeping users informed about their link statuses will be crucial for everyone involved—from taxpayers like you and me right down to small businesses managing online transactions.

Stay tuned as more updates roll in regarding how your Aadhaar-PAN status is managed over time—after all, it plays a vital role in ensuring smooth financial navigation throughout India's digital transformation.

Summary

In our journey through understanding Pan-Aadhaar Link Status, we've navigated from its inception as an essential step towards financial inclusion to now seeing it evolve into a cornerstone of India's digital transformation.

The seamless connection between your Aadhaar Card and PAN has become not just convenient but crucial for numerous transactions—whether at the ATM, online marketplace, or even when filing tax returns. It’s like having a passport that unlocks various doors in today’s digitally-driven economy.

Moving forward, expect more robust security measures to safeguard this vital link while also ensuring transparency around who is handling your sensitive information. Regulatory bodies are likely to tighten their guidelines on what constitutes "valid" proof of identity and transaction verification processes will become even more streamlined.

But here's the real magic: as technology continues its rapid evolution in India, we'll witness a shift where PAN-Aadhaar linkage isn't just about convenience but might pave the way for broader innovations like contactless transactions or digital government services. It’s almost surreal to think how far-reaching this seemingly simple link can become.

As you read through your monthly statements and financial reports now—check that little status indicator, it represents more than just a number; it's part of India’s journey towards becoming the world's next tech frontier powered by its citizens' identities.

So, what do you suppose will be the implications for future generations? How might this link impact industries outside finance as well? The potential is vast—and with each successful transaction or identity verification, we're one step closer to understanding how deeply intertwined our digital lives have become.

The next time a new feature pops up in your banking app asking about linking your Aadhaar Card—take it not just for granted but reflect on its significance and what more might be possible beyond transactions today.

What does the future hold? And where do you see Pan-Aadhaar Link Status taking us as we move forward together into this brave, digital new era of India’s financial landscape?